Contents:

You can also take a quote you’ve received online and bring it to your branch manager. See if they’d be willing to calling into the banks forex department and give you a matching or better rate. The alternative is to get multiple quotes from foreign currency exchange shops like TransferWise, CanadianForex, XE Trade, NorthStar, International Currency Exchange, and Knightsbridge Foreign Exchange. We actually bring a quote to our branch manager, who then calls in the foreign exchange desk to see if they’re willing to match it. You get the best price and it saves the inconvenience of having to work with an exchange bureau. On a related note, be sure to let the card issuer know that you will be abroad.

The motion to approve the Goldman Sachs, JPMorgan and Citi settlements, and class counsel’s request for fees, in Ontario is scheduled for April 13, 2017 and in Quebec on May 2, 2017. The Ontario court has approved a notice of certification for settlement purposes which, among other things, explains what steps someone can take if they object to the settlement. The motion to approve the BMO settlement, and class counsel’s request for fees and reimbursement of its disbursements, in Ontario is scheduled for July 16, 2020, and in Quebec is scheduled for August 7, 2020. Please click here to review the Notices in English, and click here to review the Notices in French. Questrade’s practice account sets it apart from Interactive Brokers and will give beginners an edge to get their heads wrapped around forex trading before putting their real money on the line. With its low fees and ease of use, Questrade is our top pick for the best overall online brokerage in Canada.

- Check your card holder agreement because in addition to the price and the exchange rate, you will be subject to foreign transaction fees.

- Our goal at RetireHappy is to present readers with reliable financial advice and product choices that will help you achieve your financial goals.

- Major costs in Canada when you return can be the purchase of real estate for living in or as an investment, a vehicle, or even money for post-secondary education for your child.

- As a Canadian, the number of platforms available in the country continues to evolve with competition being as fierce as it’s ever been.

This article reviews the best Forex broker available in Canada, their pros and cons and covers the most frequently asked questions about Forex brokers. It’s simple to open a Questrade account, you will need to verify your identity and must be a Canadian resident. Just go on the company’s website and start you application online.

Structured products and fixed income products such as bonds are complex products that are more risky and are not suitable for all investors. Before trading, please read the Risk Warning and Disclosure Statement. Note, the reference is with respect to ABM cash withdrawals, not credit card usage. But the issue is the same as they reference the VISA international exchange rate and the fact that that rate itself includes a 2.5% fee. However, if you take out a cash advance of $500 or more, you’re fee will be 1%, which is obviously better than 2.5% foreign transaction fee. Great to hear the portfolio conversion is going well for former Sears MasterCard holders who have been converted to Scotia’s Momentum Visa card.

Excellent Rates & Efficient back office

Also, be aware of the fees you’re being charged and go with the lower option. When a purchase is made in a foreign currency the exchange is calculated using Mastercard internationals current spot rate for that currency. The bank would add an additional 2.5% foreign exchange fee on this rate.

They will then charge your Canadian credit card the converted Canadian dollar amount. Because PayPal controls the transaction, they astutely convert the currencies themselves before it hits the creidt card and keep the 2.5% margin for themselves as well. As a result, if you’re are using a no foreign transaction fee credit card, it will be waisted if you use your card through PayPal. Some banks, like RBC and TD, offer online foreign exchange currency converters for their customers, so you can find out your bank’s exchange rate instantly for the most commonly converted currencies.

To add your account, OFX uses a third-party platform Plaid, an award-winning fintech solution for bank services. In other cases, OFX guarantees there won’t be any deductions from intermediary and/or receiving banks when transferring your money to the beneficiary account. Their exchange rate gets better the more you send and their margin is only 0.4%. Once you lock the exchange rate with OFX, you will know exactly how much the other side you are sending money to will receive. In order to do the calculations, I used my own OFX account with special rates and all the fees ($15) waived. In order to do the calculations, I used my own account with special rates and all the fees ($15) waived.

I.e. compared to a card which pays 2% cashback, but charges a 2.5% foreign currency fee, there is now only a 0.5% advantage, vs the previous 1.5%. The daily currency exchange rate set by your card processor, e.g., Mastercard, Visa or American Express. This is the difference between the value of the Canadian dollar and the value of a foreign currency on any given day. Scam brokers will often operate a single bank account for both their clients’ funds as well as their own operational money.

Review from Darrell A

This way, purchases will not get red-flagged and access to funds will go uninterrupted. …correction to myself (since they don’t allow editing posts) – I meant to say “… avoid ATM cash advance fees and very high interest”. But ultimately the differences between the three are quite marginal. https://forex-review.net/ All three card processors do charge a slight markup compared to the Bank of Canada’s, with Mastercard’s markup the highest at between 2.45% to 2.61%, depending on the currency exchanged. Inflated accuracy – Claims like “90%+ accuracy” are an immediate indication to be cautious.

This feedback effectively focuses on their online and phone-based support reputation while improving their overall plan of action for every situation. In our Questrade review we found that lots of users use this feature to keep their account safe. These types of insurance offer protection in the event Questrade filed for bankruptcy, or a similar event occurs.

For a large number of shares, the maximum is .5% of the trade value, plus exchange fees in some cases. My son will be attending a school in Vancouver area for one year starting in September, and I live in US. I want to transfer funds to the school to cover his tuition. I just wired a “deposit” and was disturbed to find that CIBC canadian forex review took so much in the conversion process. They claim to only take a fee of $15, but the converted funds was quite a bit lower than what the daily rates would indicate should have ended up at the school. Home Trust does not accept clients from Quebec – and the Rogers and Fido cards now include the 2.5% fee on foreign transactions .

Can You Buy Stocks on a Mobile App?

Questrade is one of the top trading platforms for Canadians who want to invest on a budget. There are no fund fees charged for mutual funds, and all stock and ETF fees are low. After further “processing” and without any complaints from me, they actually charged me an exchange rate of 1.42 plus the 3% that the cardholder agreement shows as their foreign exchange fee. Maybe they take a bit extra at first until they can fine tune the charges.

I’ve been using Oanda for currency conversion for many years of overseas travelling. It’s very user-friendly and I especially like the wallet-sized FX cheat sheet that you can print out and keep in your purse, this had proved invaluable on many occasions. Perhaps the app or website could introduce a notifications upgrade where if the currency rate changes, the user can get notified. In the financial sector you always have to be aware of the most recent currency ups and downs and Oanda helps you stay on top of that .It is easy to use and has a very pleasant design . It will be great if they make their currency converter as desktop application , however I am happy to use it online as well.

This was my first experience with

XTB Forex even includes insurance for all of their customers, covering up to 1M EUR, AUD and GBP in cover in case of bankruptcy.

Timing Considerations: “When should I convert to CAD?”

Read our guide on how to buy stocks in Canada for a complete, step by step guide for opening your brokerage account. Of course, we’re discussing safety from non-investment risk factors here. Please keep in mind that there nothing any investment platform can do to protect you from inherent investment risk.

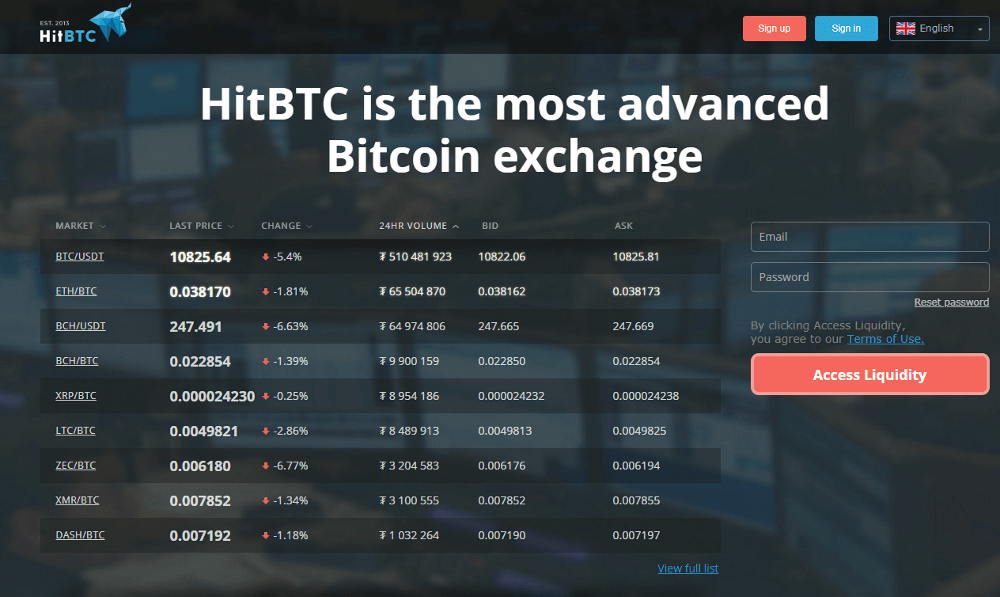

The ECNs match buy and sell orders between market participants directly without actively trading against the Forex investor. This allows ECN Forex brokers to have narrower spreads than traditional brokerages, although it should be noted that several do still charge commissions on executed trades. Forex trading works by simultaneously buying and selling a pair of currencies. Similar to exchanging one currency for another before a trip, Forex traders buy currencies on a mass scale before exchanging the currency back when the exchange rate moves in their favour. The currency exchange between two currencies such as the United States Dollar and Canadian Dollar is what is known as the currency pair.