In the chart below, we see GBP/USD price movements on a daily basis. The flagpole (the blue ascending trend line) covers the beginning of an uptrend. After a short-term peak is created, the price action corrects lower to around 50% of the initial move. In trading, a bearish pattern is a technical chart pattern that indicates a potential trend reversal from an uptrend to a downtrend.

Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Asktraders is a free website that is supported by our advertising partners. As such we may earn a commision when you make a purchase after following a link from our website.

Bull Flag Pattern

Look for a demand pole, followed by a tight pullback with lower highs and lower lows, then a breakout to resume the uptrend. A bull flag breakout is the best way to trade the bull flag pattern. After a stock has an initial bull run, then consolidates on lower volume, you expect the initial demand to return and force a new breakout in the stock. In this article, we’re going to dive into the fine details of the bull flag patterns.

With your areas now plotted, the next thing that you’re looking for is for the price to reach the area of support and make a valid bull flag pattern at it or below it. The most common implication of the bull flag pattern is to look for the right time to hop into the trend. Now, I’m not expecting us to see the same thing all the time because the bull flag pattern is a discretionary trading concept. The bullish Flag pattern is usually found in assets with a strong uptrend.

The continuation of the movement down can be measured by the size of the pole. This is a great lesson on managing risk and respecting your stops. Never assume that any pattern in the market will work 100% of the time.

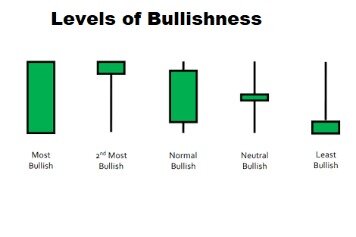

A group of indecision candles after a strong move

However, the volume should decrease as the flag chart pattern forms and increase when the price breaks below the support level. Keep in mind that the pullback forming the bearish flag does not extend beyond the pole. However, it’s worth noting that waiting for confirmation of the resumption of the market’s uptrend actually requires traders to take on a higher amount of risk. That’s because the guideline for placing an initial stop-loss order when trading the bull flag pattern is to place your stop-loss a bit below the lowest price of the flag retracement. Thus, entering a buy trade when the price breaks above the top of the flag channel risks less trading capital than entering the market at a new high price above the flag pole high. Traders can use the bullish flag pattern to identify potential trend continuation opportunities by entering a long position after the breakout.

In our example, we would have missed a great opportunity if we would have waited for a pullback to enter a trade. Most of the time we’re going to get a really big volume burst out the moment the breakout happens, which will make it harder for a pullback to develop. They are traded in the same way, but each has a slightly different shape. A flag or pennant pattern forms when the price rallies sharply, then moves sideways or slightly to the downside. This sideways movement typically takes the form or a rectangle (flag) or…

3 Top Ranked Stocks for Momentum Traders to Buy – Yahoo Finance

3 Top Ranked Stocks for Momentum Traders to Buy.

Posted: Fri, 12 May 2023 15:30:03 GMT [source]

I’ve now just learnt the bull flag trading guide and I’ll share my experience after practicing it. I have missed out big time trading opportunities for not knowing it earlier. Well, it’s a term I coined https://trading-market.org/ when the market breaks out of a range and then does a pullback for the first time. You can also confirm a flag pattern by waiting for the initial trend to resume before you open your position.

However, I prefer to trail my stop loss until the market takes me out of the trade. Just look through your past trades and notice how often you got stopped out only to watch the market do a complete reversal. The trading room is for educational purposes only and opinions expressed are those of the presenter only. All trades presented should be considered hypothetical and should not be expected to be replicated in a live trading account.

Let’s look at some examples of bullish flags appearing on price charts in order to illustrate the concept and how they appear visually. In this example you have AMC breaking out of its prior trading range on increased volume. The optimal place to buy a bull flag breakout is once the trend begins to shift once again in the desired direction. In this 30-minute chart example, you can see that the first candle to make a new high inside the bull flag becomes the breakout candle. If you can identify key levels on a chart where shorts could be underwater, then see a bull flag form, it could be indicative of a coming squeeze.

Tight Bull Flag

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. After execution of pending buy orders, the price will break the channel and continue to move upward. If the price breaks out of a range, then wait for a Bull Flag Pattern to form.

- Look for strong and obvious price boosts with successive price sticks, price gaps, and strong volume, all pointing in the same direction.

- All trades presented should be considered hypothetical and should not be expected to be replicated in a live trading account.

- When bullish flag pattern forms on the price chart then it signals that price will continue the bullish trend.

- We also have a great tutorial on the most reliable bullish patterns.

- You could, for instance, move both your stop and take profit as the market approaches the first profit target.

The bull flag pattern is one of many trading strategies used by traders either to enter a market on the buy side or as an opportunity to add to existing long positions. When you’re able to tighten your stop loss at the levels the bullish flag pattern allows you to do you know you’re on the right path. But, not only that, your profit potential is multiple return of your risk. In essence, you risk a little to gain a lot more which is the thing that most traders should strive for.

A bull flag fails or is invalidated once it breaks the low of the breakout candle. If we are astute traders who understand support and resistance, we could have gauged the quality of the bull flag as a small consolidation along the way to the resistance area above. This would give us confidence, not only that the move might not be finished, but also as to where our target could be set.

Bull Flag Pattern Explained: How to Identify and Trade this Bullish Signal

The channel consists of an upper trend line and a lower trend line. A buy signal is generated when the price breaks the upper trend line. Bull flags closely resemble another chart pattern – the bullish pennant. Both the flag and pennant patterns are continuation patterns that generate a buy signal following an upside breakout from a downside corrective retracement. A disadvantage of trying to trade bull flags is that so many elements are necessary for the pattern to generate a legitimate buy signal. As a result, traders may miss out on a trading opportunity because the pattern lacks one or more key features that define it, but the price breaks out to the upside regardless.

A flag pattern is a continuation chart pattern, which means it forms during a temporary price consolidation period before the preceding trend resumes. This chart pattern can be categorized as either a bull flag pattern, a bullish continuation chart pattern, or a bear flag pattern, a bearish continuation chart pattern. And as discussed throughout this guide, the simplest strategy for the bear and bull flag pattern trading is to employ the breakout trading strategy. And, just like when trading with any chart pattern, it is often advisable to use momentum and trend indicators to ascertain your entry levels. The bull flag pattern is a popular chart pattern used in technical analysis to identify a potential continuation of a bullish trend. It is formed when there is a steep rise in prices (the flagpole) followed by a consolidation period (the flag) before a continuation of the upward trend.

The pattern’s effectiveness highlights the importance of using technical analysis in combination with fundamental analysis to make informed investment decisions. However, it’s also essential to be aware of potential pitfalls or false signals that can occur with the bull flag pattern. One such pitfall is the potential for a “fake out” or false signal, where the price action appears to be forming a bull flag pattern but then fails to continue the upward trend. This can happen when traders and investors mistake a consolidation period for a bull flag pattern, leading to incorrect trading decisions. If the price breaks below the support line but closes above it, you can adjust the lower trendline to match the breakout while the pullback continues.

Key Levels to Watch as Gold Trades in a Rising Bearish Channel – Nasdaq

Key Levels to Watch as Gold Trades in a Rising Bearish Channel.

Posted: Fri, 12 May 2023 20:07:00 GMT [source]

I’ll share with you practical trading strategies that will answer all of these questions. It can contract, it can expand, and produce a lot of false breakouts. Range market is one of the most challenging market conditions to trade. However, most guides out there teach you how to spot them and not how to trade them. In our simulator here at TradingSim, you can practice trading Bitcoin with BTC futures. It is a great way to get your feet wet and test your strategies without actually risking real money in Bitcoin.

So, arguably, the most important feature of a flag chart pattern is the flagpole, which corresponds to a strong price movement. Look for strong and obvious price boosts with successive price sticks, price gaps, and strong volume, all pointing in the same direction. The flag pattern gets its name from the fact that the price action of the pattern resembles a flag on a flagpole. Typically, the flag chart pattern forms when the market is in a sustained trend – bullish or bearish, followed by a period of consolidation before the preceding trend continues.

It’s the direct opposite of the bull flag pattern – the flagpole in the bear flag pattern represents a sustained bearish trend. The flag, in this case, is inclined upwards, representing the short-lived price pullback – the pattern’s consolidation phase before the breakout. The bull flag pattern is a piece of price action that occurs on candlestick charts after a major upward move. In this article, we will explore the bull flag pattern in detail, starting with an overview of the pattern’s significance in technical analysis.

Most of you know it, but it seems that most of you don’t know how to trade it properly… (while markets exist)

Most technical analysts do know this as one of many harmonic patterns… Usually, there is a surge in volume as the stock builds the flag pole.